Celebrating Right to Build Day, the Ipswich Building Society conducted its own research into the custom and self build market. Like NaCSBA and the Building Societies Association’s survey, the Ipswich’s asked 2,000 people about their aspirations and understanding of the custom and self build sector, prompted by the way the pandemic has changed the way we see our homes.

Like NaCSBA’s research, the main finding was that 35% of UK adults (approximately 22 million people) said they would consider a self build project at some point in the future. The NaCSBA/BSA research found a similar figure, that 32% of people were interested in self building – adding empirical weight to the data.

The research found that:

- Young adults were most interested in self building

- Those in the south east were equally the most interested

- Over half said the main benefit was a tailor-made home

- 28% felt environmental considerations were important

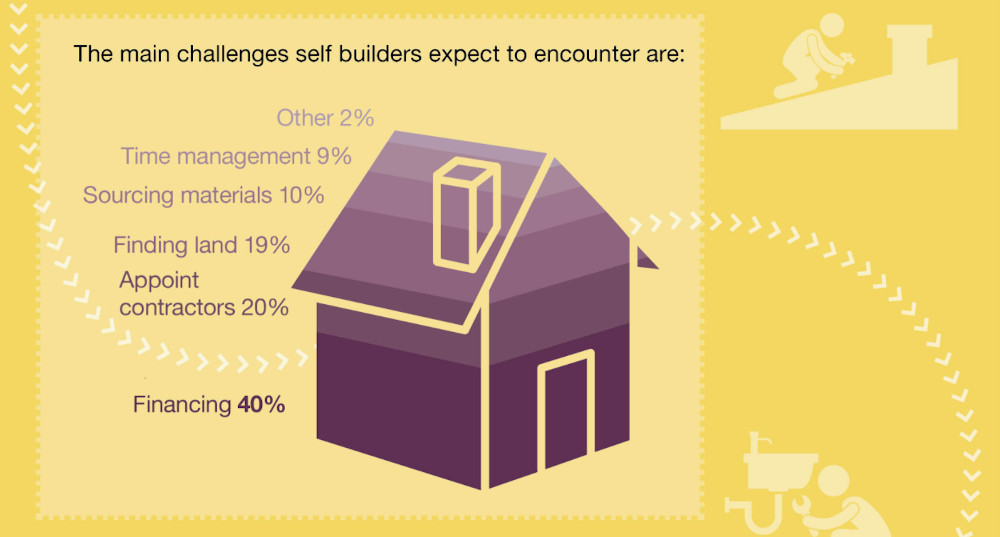

- 40% of people felt that financing a build was the main challenge

- 40% of people said location was the most important consideration when it came to finding a plot.

Charlotte Grimshaw, Head of Mortgage Sales at Ipswich Building Society said: “Since the introduction of government legislation on 1 April 2016, self build projects have become a more recognised and viable choice for many people.

“However, finding the perfect plot of land is still something that self builders are concerned about. The introduction of Right to Build was a significant step for this often overlooked sector and with the UK having the lowest known rates of self build homes in the world, coupled with a substantial shortage of homes, local councils would do well to promote these registers more tenaciously, to ensure a continual supply of suitable plots.”

Lack of awareness about self build mortgages

The Ipswich Building Society commented that those planning to embark on a self build project should be aware of the classification of their build with regards to their mortgage application. This research reveals that more than half (52%) of people were unaware they would need a self build mortgage and not a standard residential mortgage for the major renovation of any property or self build project.

Ipswich Building Society advises that if the mortgage applicant has to live in a separate dwelling during the build, or if major renovation work leaves a property without kitchen and/or bathroom facilities for an extended period of time, this would usually fall under most lenders’ criteria for self build.

However, as self build mortgages are more complex than a standard mortgage application, it can be advisable to seek guidance from a mortgage intermediary who has experience in this area.