A new Help to Build equity loan scheme was announced in the Comprehensive Spending Review, another green light for those wanting to custom or self build, says the National and Custom and Self Build Association (NaCSBA).

The new scheme was announced as part of a package of measures to support more people to build more sustainable and more beautiful homes.

Important for anyone considering a custom or self build, the Comprehensive Spending Review made two important announcements:

As yet, there are no firm details about the format or timescale of the Help to Build scheme. However, NaCSBA will be working with the Ministry of Housing, Communities and Local Government to feed into the design of the scheme. NaCSBA has been lobbying for a Help to Build scheme for several years, so welcomes the announcement.

Currently, it is expected that the Help to Build will be an equity loan scheme along the lines of Help to Buy, but with the loan subsidising the mortgage lender, rather than the house builder, as with Help to Buy. However, for now the details remain uncertain.

The Help to Build will help more people self build who would otherwise struggle to finance a build, great news for the third of people who want to self build, the result of recent research by NaCSBA and the Building Societies Association.

Of these 1 in 3 interested in self building, 59% of respondents said that access to finance remained the most significant barrier preventing them from self building. Help to Build should help remedy this, and make a real difference to the younger age groups where there was the interest in self build was strongest.

NaCSBA also welcomed the news of further funding, especially to support the release of public sector land for serviced plots. Access to suitable land remains a challenge, as acknowledged by 42% of those surveyed in NaCSBA’s recent research.

Public sector land is land held by councils, government and large institutions, and a commitment to bring some of this land to market for plots could provide a valuable route to land.

Access to plots and ability to secure finance have traditionally been significant challenges for anyone wanting to self build, and these announcements reflect government’s ambition to support more people in their ambition of having an owner-commissioned home.

Andrew Baddeley-Chappell, NaCSBA CEO, said: “The announcements today, together with those on Right to Build Day, make it clear that the Government is fully committed to do more to increase the diversity of choice in our new homes market.

“Greater choice will lead to great innovation and competition that will lead to more and better homes. We hope to see the new Help to Build scheme up and running as soon as possible together with the additional wonderful, affordable sustainable, uplifting new homes that it will help deliver.”

Help to Build will only be available in England, but Wales already has Self Build Wales, which includes a loan for anyone wanting to self build.

Find out more in Build It magazines interview, or at the scheme’s hompage: Self Build Wales.

Celebrating Right to Build Day, the Ipswich Building Society conducted its own research into the custom and self build market. Like NaCSBA and the Building Societies Association’s survey, the Ipswich’s asked 2,000 people about their aspirations and understanding of the custom and self build sector, prompted by the way the pandemic has changed the way we see our homes.

Like NaCSBA’s research, the main finding was that 35% of UK adults (approximately 22 million people) said they would consider a self build project at some point in the future. The NaCSBA/BSA research found a similar figure, that 32% of people were interested in self building – adding empirical weight to the data.

The research found that:

Charlotte Grimshaw, Head of Mortgage Sales at Ipswich Building Society said: “Since the introduction of government legislation on 1 April 2016, self build projects have become a more recognised and viable choice for many people.

“However, finding the perfect plot of land is still something that self builders are concerned about. The introduction of Right to Build was a significant step for this often overlooked sector and with the UK having the lowest known rates of self build homes in the world, coupled with a substantial shortage of homes, local councils would do well to promote these registers more tenaciously, to ensure a continual supply of suitable plots.”

The Ipswich Building Society commented that those planning to embark on a self build project should be aware of the classification of their build with regards to their mortgage application. This research reveals that more than half (52%) of people were unaware they would need a self build mortgage and not a standard residential mortgage for the major renovation of any property or self build project.

Ipswich Building Society advises that if the mortgage applicant has to live in a separate dwelling during the build, or if major renovation work leaves a property without kitchen and/or bathroom facilities for an extended period of time, this would usually fall under most lenders’ criteria for self build.

However, as self build mortgages are more complex than a standard mortgage application, it can be advisable to seek guidance from a mortgage intermediary who has experience in this area.

Head to the National Self Build and Renovation Centre for its show on Friday 16-Sunday 18 October, which is one of the few shows still running a live event.

The National Self Build and Renovation Centre is a permanent exhibition space dedicated to self building, with permanent stands and educational exhibits helping you to navigate the process of self building or renovating a home.

The show is the ideal event to meet experts and see and test products in a spacious and relaxing setting – with measures in place to ensure social distancing requirements are met.

The show offers something for everyone, no matter what stage you are at with your project – whether you are still at the early planning stage or part way through.

The centre has experts on hand with offering a range of advice, from finding a plot and arranging your finances to deciding on the best building method for you. As well as lots of information about heating systems, green building and more.

When: Friday 16th – Sunday 18th October

Time: Fri & Sat: 9:00am – 5:00pm; Sun: 9:00am – 4:00pm

Where: NSBRC, Just off M4 Junction 16, Swindon, SN5 8UB

Tickets: Free in advance, £12 on the door.

Special measures have been put in place to ensure the NSBRC and show safeguard its visitors, exhibitors and staff. It is working hard to ensure it complies with current guidelines and as such this show will be a little different from previous events.

In order to maintain social distancing, the centre is reducing the capacity of the event and requires all attendees to book in advance on this occasion. Tickets are limited to a maximum of 2 adult members per household, and children must remain with their parents at all times.

Additional measures have been implemented for the safety of all, which will be explained on the day.

On 19 and 20 September, Bicester-based self and custom build development site, Graven Hill, will be talking all things self-build at Build It Live.

The event is going virtual this year, taking place entirely online. From the comfort of your own home, you’ll experience a whole weekend full of inspiration, interviews and top tips from a range of experts.

Graven Hill has a long-running partnership with hosts, Build It, having opened the Build It Education Hub in November 2019. Home to the site’s Marketing Suite, the Hub is a self-build project itself, giving visitors the opportunity to learn about the various aspects of building their own home, including product choice, design, and construction methods.

These are just some of the many topics Graven Hill will be exploring during the virtual event, with attendees able to book live one-to-one chats or video calls with the team throughout. Whether you want to discuss plot availability, financial options, or just have a burning question, the Graven Hill experts will point you in the right direction to making your dream home a reality.

There will be an interview with self-builders, Zakima and Sam Omotayo, as well as Graven Hill’s managing director, Karen Curtin, at 1.10pm on the Saturday. They will be speaking about why Graven Hill was right for them, their self-build process, and offering advice to prospective self-builders. This will also include a live Q&A, so attendees can ask any questions they may have to people who have experienced self-building first-hand.

Self Builders Sam and Zakima Omotayo

Zakima and Sam, said: “Being able to share our self-building journey with an audience of like-minded people is something we’re really looking forward to. Our experience at Graven Hill has been so rewarding, and if we’re able to inspire others to take the plunge then that’s the cherry on the cake.

“Self-building is an option that people rarely consider in the UK, but we’d love to see that change. We now live in a home that reflects our style and needs, and we are very happy.”

For those unsure about whether self-building is right for them, the Graven Hill team will also be able to explain the site’s custom build new homes. These take the ease of a conventional new build and combine it with the personality of a self-build. Perfect for people who want a unique home without the heavy lifting.

Eligible for Help to Buy, custom build new homes are also accessible to all, including those aiming to get a foot on the housing ladder.

Karen Curtin, managing director of Graven Hill, said: “The UK has yet to fully embrace the concept of self and custom building, and Build It Live gives us the opportunity to spread the word about its potential, as well as quash certain misconceptions. At Graven Hill, our aim is to provide an accessible route to building your dream home, something that is often dismissed due to time and cost.

“This year’s event may be virtual, but we’re certain it’ll inspire a whole new set of budding self-builders to give creating a home that fits their every need a try.”

Whether you’re looking to start a self-build project of your own or are just curious about what Graven Hill has to offer, make sure to book your place at Build It Live. For exclusive offers, speak to the site’s sales team during the show.

Land promoter Leaper Land has submitted an outline planning application for a 65-plot site on the edge of the village of Child Okeford. Routes to home ownership at Child Okeford include self-build, custom-build and custom-choice, with the custom-choice built to a shell stage, at which point it is handed over to the purchaser.

Routes to ownership at Child Okeford:

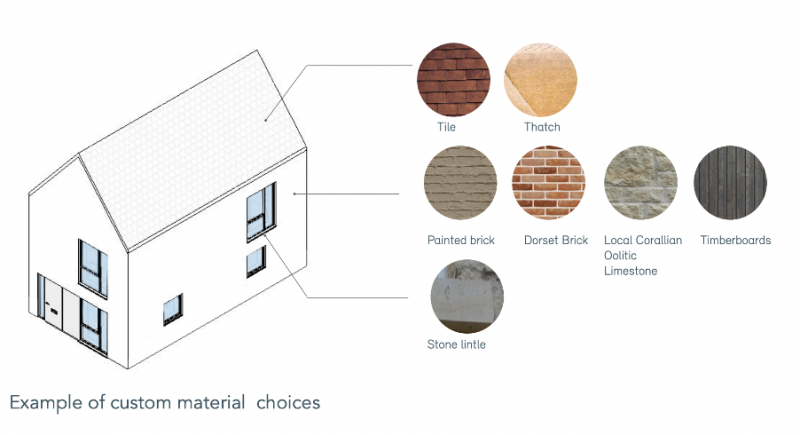

Self-build individuals buy a serviced plot, with details of what is allowed to be built set out in a design code and with a palette of materials to choose from. As the design code is pre-approved for planning, permission is guaranteed as long as your build meets the conditions set out in it. Buyers can also choose to project-manage themselves or commission a developer or housebuilder to build the home.

Custom-build with this model, you buy the plot, with the design code setting the context, and contract directly with a developer to build the house. On this scheme, this route offers less of flexibility as there is a choice of designs with pre-prepared layouts and specification options that are approved by planning.

Custom-choice this option involves a developer building your home to the wind-and-watertight structure shell, at which point you take over to commission the remaining jobs. Buyers will pick from a range of interior layouts and specifications.

Street view of Child Okeford scheme

While the self and custom build routes offer stamp duty savings and exemption from the Community Infrastructure Levy, custom choice enables people to access regular mortgages and Help to Buy. This extends the site to a greater number of buyers.

The homes are controlled by a design code, which is quite strict as it sets the context for the development, in response to the rural nature of the site. This gives the buyers choice, such as a range of materials, shown below, but by controlling this through a design code it ensure the designs are in keeping with the village.

Child Okeford custom build homes – material palette showing choice for exterior materials

“Design codes are really important as they offer reassurance to both the planners and the local community that something of quality will be built. So residents can choose from a palette of materials, for example, all of which could be seen on buildings in the village, helping the scheme at Child Okeford fit in,” said Ben Marten, Director of Leaper Land.

Bringing forwards land for development is costly and time consuming, which is where a land promoter comes in. They act on behalf of the landowner, using their skills and knowledge to secure a planning application.

As such, land promoters can help unlock small parcels of land that otherwise might not come forward. This may be because these sites are too small for big developers to be concerned about, but too costly or time consuming for an unexperienced landowner to bring forward by themselves.

Therefore, they are an ideal solution if you are a farmer or other small landowner who sees potential in their site, but are not sure how to proceed. Typically, their costs are based on results, which makes them a good choice for such landowners.

If you are planning to build, sign up to your local Right to Build register – you can find out the details on the Right to Build Portal.

Once planning is granted they will be in touch with more information and expected times for plots to come to market.

Images: Pollard Thomas Edwards/Leaper Land

On 8 July Chancellor Rishi Sunak announced a temporary change to the Stamp Duty Land Tax in England as part of the mini-budget that included a range of measures for bolstering the economy as we enter the biggest financial crisis since the Second World War.

In total the measures are part of a £30billion economic stimulus package, and the idea behind the SDLT holiday is to bolster the construction industry. Sunak confirmed that construction contributes £39billion to the economy, providing three quarters of a million jobs, and that confidence is key to activity.

The Stamp Duty relief (for England) results in a temporary increase to the Nil Rate Band of Residential SDLT from £125,000 to £500,000. This temporary cut commences immediately, and run until the end of March.

Industry welcomed the news, especially as it will keep the first time buyer market flowing. Since the easing of lockdown there has been frenetic activity in the property market, in part due to pent up demand. However, this is also due to a lot of people reassessing their living space having been required to stay in for months, with more space and access to the outdoors high on the priority list for many.

Stamp Duty is a tax in need of reform, as in areas with high values, which are extensive these days, it is a charge that hampers activity, restricting both downsizers and upsizers. Government has a tool that you can work out the amount of Stamp Duty due.

SDLT is actually a benefit for most self builders, as the duty is only payable on the land and not on the finished home, so on the face of it this will not make a dramatic difference. However, where it will help is that it will encourage more activity in the market, and any fluidity is always good.

For self builders, Stamp Duty is due on each plot but the rate varies depending on whether your plot is effectively a virgin building plot or already part of the curtilage of a residential property, such as a the garden of a property.

NaCSBA CEO Andrew Baddeley-Chappell commented saying, “It is great news that Government is doing all it can to keep the housing market flowing, as a liquid sales market supports people in their ambitions to move or build from scratch.

“Self builders have always benefitted from a favourable relationship with Stamp Duty, but right now we welcome any measures that keeps builders building and homes coming to market.”

Photo credit: https://www.flickr.com/photos/communitiesuk/

Custom Build Homes has released The Furlong, a site of five detached oak-framed homes in the Herefordshire countryside, with plots ranging from £145,000 to £210,000.

The homes at the Furlong are a selection of oak-framed homes with generous living spaces and gardens. The properties all include stand-alone garages and the opportunity to create a home office, a crucial element of modern life in a post-Coronavirus era.

In terms of customisation, buyers have the opportunity to feed into the internal design of their new home. Consequently, people the flexibility of designing a layout to suit their lifestyle, both now and in the future.

The development is brought to market by custom build enabler, Custom Build Homes, together with support from specialist oak frame T.J. Crump Oakwrights’ and award-winning A1-rated building contractor G.P. Thomas Construction.

As a custom build enabler, Custom Build Homes is bringing on new places where people can design and create their own homes, such as these customisable homes.

The development of three- to five-bedroom homes is on the southern edge of the Mortimer Forest, with easy access to the countryside, as well as the towns of Leominster and Ludlow.

Ryan Blair, Sales Director at Custom Build Homes, said: “With our housing stock under the spotlight after a period of lockdown, never has it been more important to listen to what people need from their homes and deliver new opportunities that respond to those needs.

“This development will enable us to support new homeowners to live better by design and we are looking forward to supporting them throughout their custom build journey.”