BuildStore has launched a new range of low-cost mortgages for the self build sector, including a new product in partnership with Furness Building Society.

With over 25 years’ of experience and over 30,000 completed projects, BuildStore identified a need for a low-cost mortgage range to support more people as they work to achieve their goal of self building.

The first low-cost product from the Furness Building Society has a discounted rate at 2.7% below the society’s Mortgage Variable Rate for the first two years, which has a current pay rate of 5.99%.

With this product customers can borrow up to 70% on land and build costs or up to 100% of build costs if the plot is already owned. A completion fee of £1,500 applies, and early repayment charges will apply for the first two years.

This is the first product in the new low cost range, with several of BuildStore’s lenders preparing to launch low cost product.

Traditional self build mortgages from high street lenders carry the risk of receiving less money than expected due to down valuations, which can cause serious cashflow problems, and cause your build to grind to a halt.

BuildStore’s cost-based mortgages provide guaranteed stage payments, which are agreed upon as part of the mortgage and are linked to your project’s build costs.

This means that borrowers can confidently plan their finances, knowing precisely how much funding they will receive at each product stage, ensuring financial transparency throughout your construction journey.

BuildStore provides a detailed forecast of your build costs, carried out by a construction professional as part of your mortgage application, saving you time, ensuring your budget is realistic and reducing the risk of running out of money. They also analyse your cashflow to ensure you always have money in the bank to keep your build moving.

Chris Martin, BuildStore’s Head of Mortgages, said: “We’ve built a reputation over many years as the UK’s leading self build mortgage broker. Our mortgages remove the risks associated with other products by helping customers ensure they have properly budgeted their build and know exactly what they’ll receive at each stage of their project.

“This new range is available for self and custom build, conversion, or renovation projects. It provides the extra benefits and peace of mind of a BuildStore mortgage at a low cost and makes getting a mortgage for a homebuilding project even more affordable.”

Read about the new Consumer Duty for mortgage companies.

In July 2023 the Consumer Duty came into force, a set of new mortgage industry rules that changed the way mortgage advisers operate. This reinforced the need for mortgage advisers to make sure that they, and the mortgage deal they recommend, produce the right outcomes for their customer.

To help custom and self builders understand the Consumer Duty changes, Chris Martin, Head of Mortgages at leading self-build mortgage broker BuildStore Mortgage Services explains how the rules should ensure you get the right deal to fund your project.

“The new Consumer Duty rules focus on making sure mortgage products and services offer fair value, that customers fully understand how the product works and what features, benefits and risks are included and that the customer gets the right support through the mortgage process,” explains Chris.

“They specifically refer to advisers having to focus on ‘avoiding foreseeable harm’ when helping their customers. This means that mortgage advisers need to look at their customers’ needs and consider what could go wrong and if the product they’re recommending adequately deals with these risks.

“Arranging a mortgage to pay for your self build is more complex than simply getting a better deal for the mortgage on your current home.

“Unless you’re fortunate enough to have another property to raise money on to pay for your build, you’re likely to look for a stage payment self-build mortgage where money is handed over to you by the lender as your build progresses.

“The key question to ask your adviser here is how the lender decides how much they’ll release to you at each stage of your build. Money you spend on your build – particularly in the early stages – is often not reflected in the lender’s assessment of the value of your part-built site.

“If your lender releases money based on an uplift in the value of your project, then you run a real risk of not getting what you need and running out of cash. This could lead to long delays and scrabbling around to find funds from elsewhere.

“At worst your build could come to a standstill and contractors could move to other jobs. If – as is common on custom build sites – you have a contract with the builder where you have to make specific payments at certain times, then you could find you’re in breach of your contract if you can’t get the money you need from your lender.

“This scenario is the most relevant example of a ‘foreseeable harm’ for self or custom build – and can be easily avoided. There are many deals available where the lender agrees a schedule of stage payments as part of the mortgage application and links these to your build costs as they come about – there are no valuations during your project so you know from the start exactly what you’ll get as your project progresses.

“If you only ask your adviser one question, this is the one to go for. If you’re recommended a product which needs a site valuation each time you want more money, you need to ask your adviser to confirm how they’re sure you’ll get the money you need to cover your costs at each stage.

“At BuildStore we’ve seen the arrival of the new rules as a great step forward as we know that getting the wrong mortgage deal can have huge consequences for self-builders. We’ve been helping people fund their homebuilding projects for over 25 years so we’ve seen everything that can go wrong. We offer a package of products and processes to help avoid these problems – what are now being called poor outcomes and foreseeable harms.

“We’ve got access to over sixty guaranteed stage payment, no valuation mortgage deals and we provide a professional check of build costs for every customer to make sure their expected costs are realistic. We’ll also review each customer’s cashflow through their build to make sure they won’t run out of money, based on the cash available, expected build costs and agreed mortgage releases.”

BuildStore recently carried out a review of the self-build mortgage market and realised that some self-builders – particularly those who are borrowing a lower proportion of their project costs – were more likely to choose their mortgage deal based on interest rate and fees without fully understanding if the product has the right features to make sure their build is successful – and avoid poor outcomes and harms.

To make sure everyone has the opportunity to get their mortgage at a great price and get the features and support they need to complete their build successfully, BuildStore has launched a range of exclusive new deals.

These products offer market-leading rates and fees to those who need to borrow less than 70% of their build costs, with the benefit of guaranteed stage payments, no valuations, a free cost build cost assessment and support from our team right through the build.

For more help and advice visit our help section on the Self Build Portal

NaCSBA member Potton is celebrating its 60th year in the timber frame business with its first open day in 2024 on Saturday 6th January at its St Neots show centre

The day is a packed overview of the entire build process when building with Potton, ideal for novice and serial self builders. As well as the opportunity to see the range of show homes on the site, visitors can drop in, without an appointment, to have a chat and their questions answered.

Potton’s self-build consultants will be in the Gransden to offer expert advice informally, or with one-to-one sessions, and there is a programme of morning talks visitors can join.

Seminar timetable

10.40am – 11.20am Build & Budget. An overview of the self build process.

11.40am – 12.20pm Timber frame or SIPS Discover the pros and cons of these different build systems and the benefits of offsite construction.

12.40pm – 1.20pm Designing your dream home. A step-by-step guide to designing your ideal home, including the local authority planning context, approvals and tailoring your home to your needs.

Plus on the day, each show house a specialist in it acting as a hub with the: Design Hub in The Milchester, the Land Hub in the Wickhambrook, the Build Hub in The Elsworth.

Plus you’ll get the chance to raise a glass of fizz to Potton to celebrate it’s 60th year!

Self builders in Scotland need to be quick if they’re hoping to apply for the Self Build Loan Fund, which closes on the 31 August 2022.

Administered by the Communities Housing Trust (CHT) on behalf of the Scottish Government, the fund is designed to support self or custom builders, allowing them to finance the construction of their new home up to a maximum of £175,000.

In March 2021, Scottish government extended the Fund for another year to allow for the inevitable delays brought on by the pandemic and its impacts on labour and materials. At the same time it boosted the fund by £2 million.

The fund was launched on 1 September 2018 and is open to applications from individuals who have been unable to secure self-build mortgage finance from the mainstream market for their project, but are in the position that they can repay the loan by 31 August 2023.

To date, the fund has financed the projects of 40 families and individuals in 13 local authority areas: Aberdeenshire, Argyll & Bute, East Ayrshire, North Ayrshire, Falkirk, Highland, South Lanarkshire, Orkney, Perth & Kinross, Scottish Borders, Shetland, Stirling and the Western Isles, with more to come.

In February 2021 the CHT created a short briefing paper about the impact of the fund, which you can see here and captured in the infograhpic below.

This reflected growing demand for the Self-Build Loan Fund, with increasing interest over 2020, rising by 153%.

Main image: Image by Sharon Ang from Pixabay

Ethical lender Ecology Building Society is incentivising sustainable building with a new range of discounts for the most energy efficient homes on its C-Change mortgages for custom and self build homes.

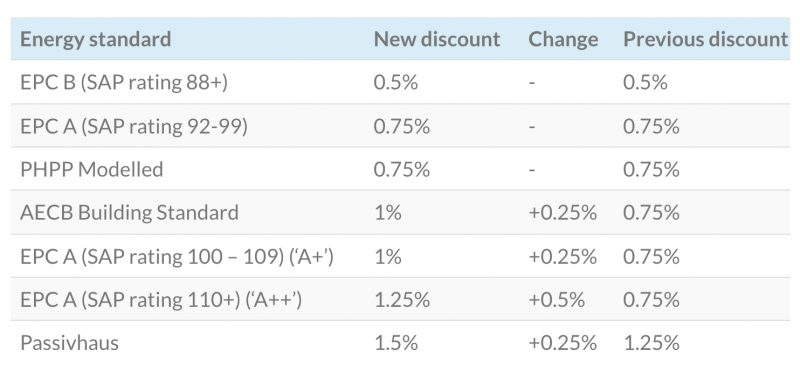

The new discounts have a maximum discount of 1.5% off the rate for homes that reach Passsivhaus standards, with a sliding scale of discounts available for other highly energy efficient standards. The enhanced range builds on the building society’s record for supporting sustainable and energy efficient projects.

Not only do the new discounts help meet the UK’s net-zero ambitions, but they are a welcome incentive at a time of increasing mortgage rates and the wider cost of living crisis.

Ecology’s self-build mortgages start with an initial rate of 4.99% during the construction phase of your project (from 1 August). Once completed, borrowers who have achieved the right standard are eligible for a C-Change discount of up to 1.5% based on the SAP rating in the EPC (Energy Performance Certificate) or if the property is accredited to the AECB Building Standard or Passivhaus standard.

The changes also include the addition of dedicated discounts for homes built to a SAP rating from 100 to 109 and SAP ratings of more than 110, of 1% and 1.25% respectively. This is a first, which Ecology is referring to as A+ and A++, that reflects the environmental performance of homes built to a standard that generates more energy than they consume.

Building Regulations require that a SAP calculation and a predicted ‘On construction’ Energy Performance Certificate (EPC) is submitted for new dwellings prior to building work commencing.

For example, if the finished build is accredited to the Passivhaus standard a discount of 1.5% applies giving a variable rate of 3.49% for the remaining term of the mortgage (from 1 August). An application fee of £799 is payable and applicants can borrow up to 80% of the property’s value in stages to support the progress of the build.

The decision to enhance the discounts comes at a time when the government is recognising the urgent need to reduce the carbon impact of house building and has stated that new homes much reduce carbon emissions by 75% by 2025.

The Society also offers a Renovation Mortgage where a property is being purchased for renovation or retrofit. They will consider lending on homes in any condition, as long as the works required improve the energy efficiency of the property. On completion of the renovation the Society’s retrofit discounts apply.

Daniel Capstick, Ecology’s Mortgage manager explains, “Now more than ever it’s important that lenders play an active role in incentivising green building and helping to reduce energy bills. We’ve been leading the way on sustainable mortgages for over 40 years, and we hope that the updates to the C-Change discounts will encourage our borrowers to build even more energy efficient homes, which is critical in the fight against climate change.”

Mark Stevenson, Chair of the National Custom and Self Build Association said: “NaCSBA knows that custom and self-builders lead the way in innovation and sustainability, as individuals invest more in a home that they have designed to suit their needs than a speculative builder would.

“This was evidenced in our 2022 Custom and Self Build Market Report, where over half of all self-builders said they had used a sustainable heat source in their project. Ecology’s new discounts are a welcome incentive in the market, rewarding those who want to build a more sustainable future for themselves and their communities, and which set a challenge for the wider industry to raise its game and promote more sustainable construction practices.”

Image credit: Image by MVOprp from Pixabay