In England, most authorities charge Section 106 planning contributions, so do your research and ensure that any fee does not go unbudgeted. This can be complicated as amounts vary by application and by authority, depending on what they deem to be their needs.

Contact your local authority and thoroughly investigate its approach at the earliest stage you can to get an indication of costs, if levied at all.

Planning contributions are often required of development to balance (mitigate) the impact of development on local infrastructure or the community. This is an agreement between the person or organisation applying for planning and the local planning authority.

Section 106 payments are often used to support the delivery of affordable housing in England and Wales, and charges vary considerably as they are based on specific local needs, so are not tariff based, unlike CIL.

Developer contributions can be levied in Scotland under Section 75 or under Section 76 in Northern Ireland.

Such a contribution would most likely be a payment or – on larger sites – a requirement for some affordable on-site dwellings

In 2014 government in England introduced an exemption from Section 106 contributions for small- to medium-sized developments, which meant that most custom and self build was also exempt.

The change was made to the National Planning Practice Guidance, but this was challenged in 2015 by Reading and West Berkshire authorities, and deemed unlawful.

While the exemption no longer stands in practice, the situation varies council by council, so contact your local authority and investigate their approach to Section 106 contributions.

The National Planning Policy Framework (2023) sets out the principle of S106 in Paragraph 66 and also in Annex 2: Glossary.

The National Custom & Self Build Association (NaCSBA), the organisation behind the Self Build Portal, lobbied on behalf of self builders and custom builders for the S106 exemption, and continues to press the case.

While many self builders have to simply pay Section 106, we do occasionally hear of individuals challenging the charge, but you’d need specialist help to do this, most probably with a planning consultant to support you – which can be an additional costs. See the Members Directory for consultants.

The Community Infrastructure Levy (CIL) is a planning charge in England and Wales only, originally introduced by the Planning Act of 2008. It is applied by councils when someone secures planning permission for most types of new building. Not all councils levy CIL, so check with yours.

Different councils charge different levels of CIL while some don’t charge it at all. Charges vary from £10/m2 to £575/m2 – see the government guidance for more.

The tax is paid by the developer and the charging point is the commencement of construction as set out in section 56(4) of the Town and Country Planning Act 1990 – broadly accepted as the point at which some limited works begin on site to implement a planning permission. This includes demolition and other minor groundworks, the digging of trenches, laying of pipes and changes to the use of the land.

Find out more on the Planning Portal.

The money raised by the CIL charge is used to fund a wide range of local infrastructure costs such as flood defences, schools, hospitals and other health and social care facilities, parks, green spaces and leisure centres.

Any new build house, flat or an extension of more than 100 square metres gross internal floor space is likely to incur a CIL charge (where a council has introduced the CIL regime).

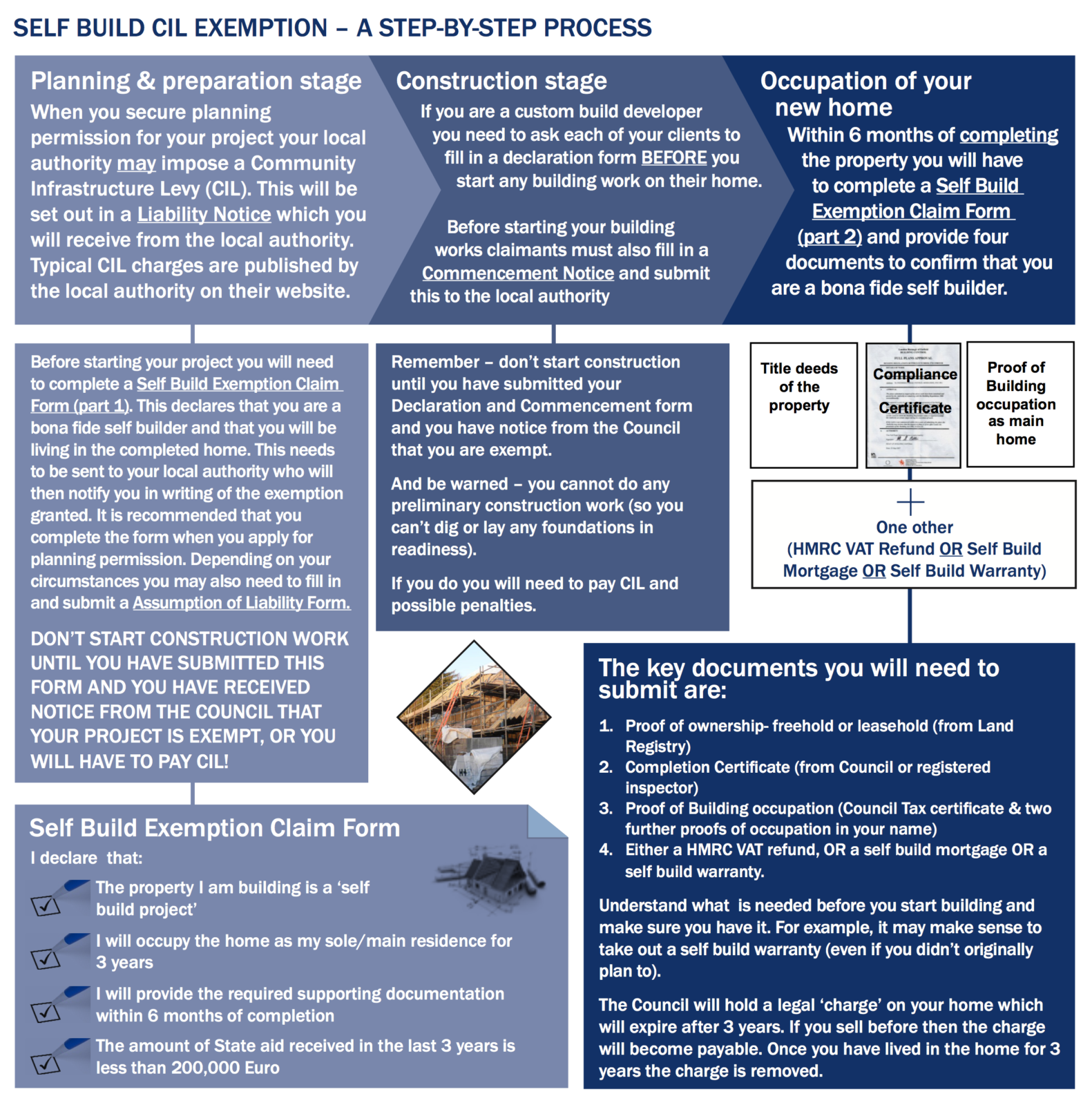

The amended regulations came into force in March 2014 but allowed for a CIL exemption for self builders building their own home, or has commissioned a home from a contractor or builder. While this is good news for Self Builders, there are caveats and the procedure to claim exemption must be followed precisely (see diagram below).

Any exemption must be granted prior to the commencement of the development or the full exemption will not be applied. You will usually need to advise the local planning authority before commencement, so be sure to seek agreement to the formal claim for exemption before starting any work on site.

There are four clear steps, with fixed timelines. The Planning Portal has links to the specific self build forms here.

1: Assume Liability Individuals wishing to claim an exemption must first ‘assume liability’ for CIL by completing a Transfer of Assumed Liability form (find the general CIL forms on the Planning Portal, and check with your council that you have the right one rather than assuming).

2: Fill in Form 7 – Part 1: This is your application for the exemption by completing the ‘Self Build Exemption Claim Form – Part 1’.

To secure the full exemption you must apply before you have commenced ANY work.

3: Commencement notice: It is essential that the local authority is notified of the intention to commence the development by submitting a ‘Commencement Notice’ to the council prior to work commencing on site.

Previously, failure to do this meant the full CIL would be payable, but following lobbying work by NaCSBA, in 2019 amendments were made that allowed for late submission – in which case the the charge will be limited to a 20% surcharge. See paragraph 7.7 of the THE COMMUNITY INFRASTRUCTURE LEVY (AMENDMENT) (ENGLAND)

(No. 2) Regs 2019 for details. This was because many self builders were missing the deadline and were getting landed with huge bills.

4: Complete Part 2 Form: On completion they must submit an ‘Exemption Claim Form – Part 2’ to the council which provides supporting evidence to confirm the project qualifies for relief (this must be done within six months of formal completion of the home).

The key documents and forms you need can be found on the Planning Portal, together with guidance as to how to apply for a self build exemption:

If buyers are to benefit from the very substantial value of the CIL exemption for custom and self build, developers of serviced plots must apply for a phased planning permission with each plot constituting a separate phase to ensure that commencement on one part of the site does not trigger the application of CIL on the whole development.

If you are buying a serviced plot, raise this point with the developer or enabler to confirm they are following the correct process to allow you to secure the exemption.

Guidance on the CIL exemption is also set out in Government guidance, noticeably The Planning Portal which states the following: houses, flats, residential annexes and residential extensions which are built by ‘self builders’ where an exemption has been applied for and obtained, and, in regard to a self build home or a residential annex, a Commencement (of development) Notice served prior to the commencement of the development (see regulations 42A, 42B, 54A, 54B and 67(1A), inserted by the 2014 Regulations)

Find out more about the Government’s position.

It’s important to note that there is a three-year ‘clawback’ arrangement, so if your personal circumstances change and the property is sold within the first three years you must notify the council and the full CIL levy becomes payable. Failure to notify the council will result in enforcement action and surcharges become payable.

Also, if any exempted annex is used other than as part of a single dwelling, is let out or sold (unless as part of the main dwelling and to the same purchaser) then the full levy due will be payable.